What Does an Accountant Do? What You Should Know About This Career

Accountants help you with your taxes, and they’re indispensable in business. But what exactly are accountants, and if you were one, what would you do every day?

Accounting is a significant piece of the financial services puzzle and something that everyone will need help with at some point in their life. From large corporate finance departments to helping individuals with their personal finances, accountants can embark on several career opportunities.

If you’re looking into accountancy as a viable career path, it’s important to equip yourself with all the relevant information.

So, what do accountants do?

An accountant is a finance professional who can work for both businesses and individual clients. They are responsible for analysing, interpreting and reporting on financial matters. Accountants often provide advice to their clients on how to achieve financial health and maximise profitability.

A day in the life of an accountant

Depending on if you choose to work as a sole trader or within a corporation’s financial department, your typical day as an accountant will vary. However, there are common responsibilities all accountants perform, including:

Industry-specific knowledge, although critical, isn’t the only skill required of accountants. You’ll need a wide range of both soft and hard skills in accounting to ensure your clients action your advice to generate the best return, such as:

Industry overview

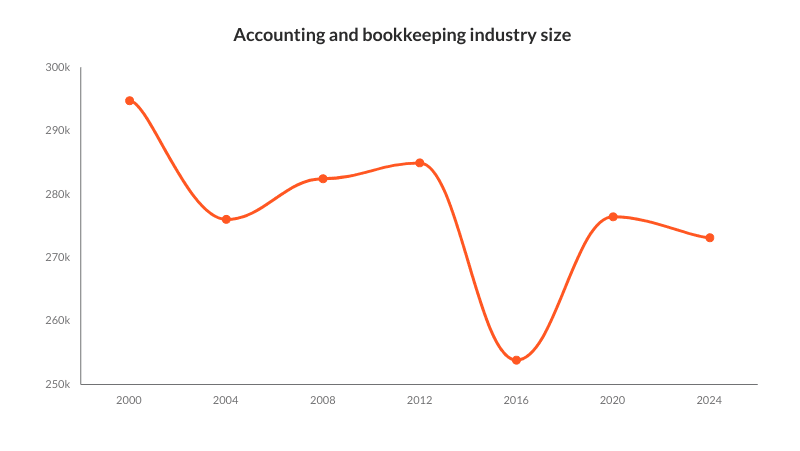

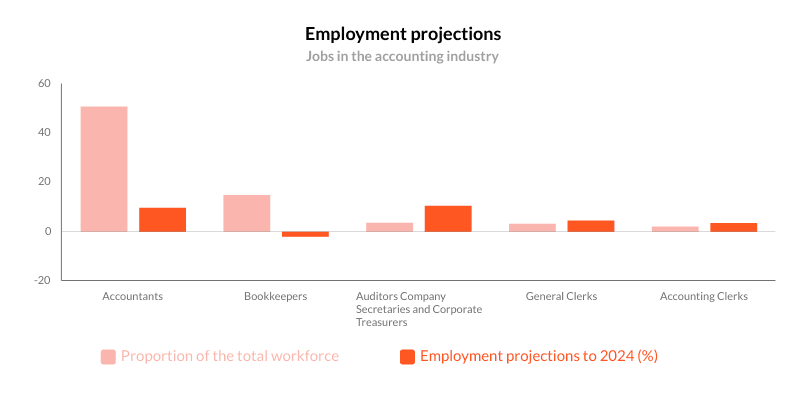

A post-COVID job economy has some sources projecting a slight decline in employment opportunity in the accounting industry. However, sources also indicate overall industry stability despite these unprecedented times. Bookkeepers and accounting clerks, for example, are expected to experience a slight drop from 276,000 industry workers in 2020 to 273, 200 in 2024. (Australian Bureau of Labour Statistics)

Licensed accountants, however, are projected to experience an employment rate rise of 10% by 2024. Corporate treasurers and auditors are expecting an 11% employment rate rise.

Pre-COVID industry projections predicted the accounting industry to continue to grow from 195,800 industry employees in 2019 to 214,800 in 2024.

An accountant’s average annual salary ranges between:

Career pathways

Choosing an accounting career pathway allows you to upskill and specialise in specific areas of the industry. These opportunities can lead you to numerous stable and well-respected professions.

Types of accountants

| Type of accountant | What they do |

|---|---|

| Public Accountant (CPA) | Provides tax expertise, auditing and financial consulting to government and non-government organisations or individual clients. |

| Management Accountant | Senior accounting role that analyses financial data to advise managerial decision making in public and private companies. |

| Government Accountant | Can work at local state or federal level. Examines and audits organisations, government agencies and other businesses subject to government policies and regulations. |

| Internal Auditor | Provide risk management and fund analysis to businesses and organisations to aid, identify and minimise financial waste or fraud. |

The impacts of COVID-19

The economic stress COVID-19 placed on Australian businesses, large and small, caused a significant uptick in demand for accounting services. This high demand for financial services is projected to continue as the economy begins to navigate the after-effects of the global pandemic.

Hays, for example, predicts accounting and finance services to be one of the most in-demand industries of 2021. Qualified accountants, payrollers and commercial analysts are identified as the most critical roles to lead organisations and small businesses alike back to a position of growth rather than maintenance.

Courses and qualifications

There are many educational pathways you can take to transition into an accounting role. Your previous experience and time available to commit to studying will help you choose which qualification suits your interests and needs.

Short accounting courses

Short courses offer an online, self-paced learning experience to maximise accessibility and flexibility. Most students complete the course load within six months.

These courses focus on training students in leading cloud-based accounting software, Xero and MYOB. Some more comprehensive courses will also incorporate accounting administration and payroll certification.

This is a great option if: you’re looking to dip your toe into the industry before committing — while developing critical basic accounting technology skills.

Certificate IV courses

Learn key accounting principles and all the hard skills required to kickstart your career. In this comprehensive TAFE qualification, you’ll cover skills such as accounting software knowledge (Xero and MYOB), preparing financial statements and BAS statements, and understanding accounts payable and receivable.

This course type will allow you to enter the financial services industry within an accounting job such as bookkeeper, accounts clerk, payroll clerk, BAS agent or accounting technician.

Bachelor’s degree

Typically a 3-year commitment, an undergraduate of business (accounting) or undergraduate of accounting will see you fast-tracked into a more senior accounting role. If financial planning, fund management, or becoming a certified public accountant are of interest to you, a Bachelor’s degree is required.

Do accountants need accreditation?

Accounting jobs within Australian professional accounting bodies or financial management require a bachelor’s of accounting or an equivalent. However, assistant accounting or bookkeeping roles do not require you to complete an undergraduate degree.

Accountant success stories

Dr Adrian Raftery

Owner of Mr Taxman

Author of 101 Ways to Save Money on Your Tax – Legally!

Susan OÇonnor

SMSF Accountant & Adviser at Susan O’Connor Accounting

Perth, WA

With the demand for accounting services continuing to grow, it has never been a better time to move into an accountancy career. If you’re ready to consider your next step, it’s time to look at your training options to help you land your dream role!