How to Become a Bookkeeper in Australia

Australia’s bookkeeping industry offers a stable yet flexible career pathway. Whether you’re looking to upskill into an affiliated bookkeeping role or want to try a completely new career pathway, we will show you how to get there in this easy guide.

What it takes to become a bookkeeper

Bookkeepers are an essential part of any business, no matter the industry. They are responsible for keeping accurate financial records that become critical consideration points when management needs to make important business decisions.

Some general responsibilities of a bookkeeper include:

- Recording all business financial transactions and cashflow

- Processing payments (invoicing)

- Daily bank administrative tasks

- Liaising with accounting to produce financial reports

- Assisting with any BAS (business activity statement) or tax-related tasks

- Payroll

Successful bookkeepers often have a head for numbers and have analytical minds.

Some important skills to develop if you’re considering becoming a bookkeeper are:

- Data entry skills

- Bookkeeping software knowledge (e.g. Xero, Quickbooks, MYOB)

- Basic accounting knowledge (profit/loss statements, financial statements, balance sheets)

- Ability to pay attention to detail

- Ability to prioritise and organise

Types of bookkeeping jobs

Now, not all bookkeepers work Monday to Friday, 9-5, in a company’s financial department. There are numerous types of bookkeeping roles out there that suit different interests, circumstances and work availability.

In-house bookkeeper

This role allows you to commit your time solely to one business (usually a small business). You are responsible for the full range of bookkeeping duties and may liaise with an external accountant to report back to management/business owners.

Accounting department bookkeeper

You work as one of (possibly) numerous bookkeepers within the accounting department of a larger company. You are responsible for the accurate recording and reporting of all business financial transactions.

Bookkeeping firm bookkeeper

You work for a larger firm that provides bookkeeping services to external clients. You may work under a long term contract for one specific account (client), or you may work on multiple smaller accounts (clients) simultaneously.

Sole trader bookkeeper

A few roles in one, as a freelance bookkeeper you own your own bookkeeping business and operate under sole proprietorship. You can work either from home or a co-working space. You take on your own clients and determine what services you provide.

A look into the industry

Bookkeeping is a large industry in Australia, with stable projected industry growth and opportunities to work both full and part-time. This career pathway also lends itself to people wishing to reenter the workforce or looking for a career change.

Statistically, most people enter this profession during their late 20s at the earliest, many of whom are female, making it a viable option for those seeking work after children.

Depending on your level of training and experience, your bookkeeping career can start from multiple entry points. Many professionals start their journey by completing a Certificate IV or Diploma.

From there, industry work experience can take you multiple directions, including becoming:

- A senior bookkeeper

- Accountant

- Financial Officer

How to become qualified

Completing a bookkeeping course doesn’t have to be a 3-year undergraduate degree commitment. Completing a short course in bookkeeping, such as a Certificate, can be enough to get you started in the industry. Many bookkeeping short courses are offered online and can be completed within 6-12 months.

Whether you’re certain bookkeeping is for you or just want to test the waters, there is a short course available to suit you and your interests.

- Short courses

Short courses are beneficial for those looking to upskill or dip their toes into what ‘could be’. These courses allow you to learn the basics, gain confidence and become knowledgeable in important accounting software such as MYOB, XERO and Quicken. - Certificates I-III in Financial Services

These education qualifications provide you with plenty of elective flexibility to explore the numerous pathways you can take in the finance industry. As the certificates progress, more skills are covered, leading to a more stable understanding of financial planning. These skills help to build the foundational knowledge required to take that final step into accountancy or bookkeeping. - Certificate IV

For those looking to become registered and practising bookkeepers ASAP, a Certificate IV in Accounting and Bookkeeping is the most straightforward method. A Cert IV prepares you for all the central responsibilities of a bookkeeper. Make sure you choose a registered training organisation (rto) that incorporates the mandatory GST and BAS units required to qualify as a bookkeeper successfully. After completing a Certificate IV, you’re ready to become a registered BAS agent with the TPB (tax practitioners board).

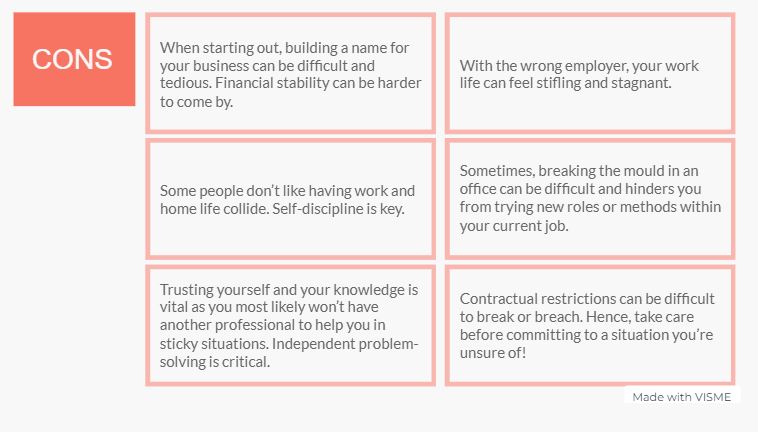

Sole trader versus employee

Whether you’re looking to re-enter the workforce or try something new, a broad spectrum of employment opportunities exist in the Australian bookkeeping industry. If you’re interested in starting the process, browsing your education pathways is a great place to start!